What a load of crap. There are so many half-truths and outright lies in there that it's not worth the paper it's written on.

$1:

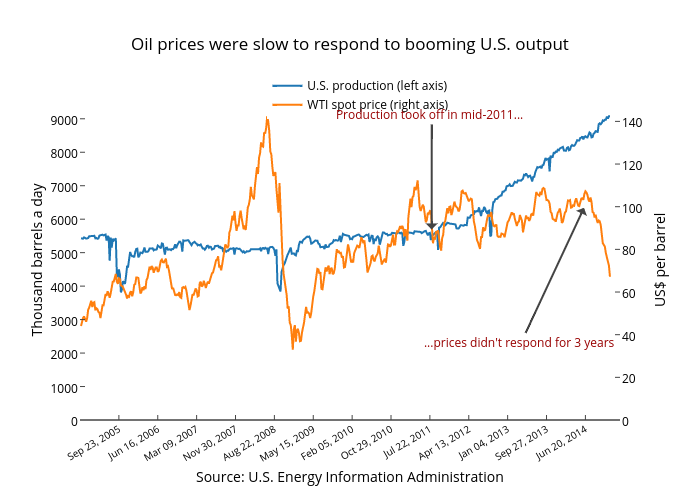

According to more EIA data, total spending by oil (and natural gas) companies grew 11 percent on average per year from 2000-2012, and spending on development activities increased by 5 percent ($18 billion) in 2013. All this culminated in the U.S. production of 7.9 million barrels of crude oil per day in 2013, a level the country hasn’t hit since 1988.

U.S. production is expected to continue rising, to 8.4 million barrels per day in 2014, and 9.1 million barrels per day in 2015.

U.S. production is expected to continue rising, to 8.4 million barrels per day in 2014, and 9.1 million barrels per day in 2015.

http://time.com/67163/why-are-u-s-oil-imports-falling/

Anyone who thinks that a measly 1.2 million BPD of production is going to drop prices this much is delusional - the truth is actually buried in your own article.

N_Fiddledog N_Fiddledog:

...has prompted the oil-rich Gulf sheikdoms to keep pumping oil even as the price falls. In their game of petro-chicken, the desperate sheiks hope that either their poorer enemies will run out of cash or that fracking in the U.S. will become unprofitable and cease.

That is why prices are falling - everyone is producing like crazy and demand has dropped.

And this has absolutely NOTHING to do with falling oil prices

N_Fiddledog N_Fiddledog:

The U.S. has suddenly become the world’s largest combined producer of oil and natural gas.

Natural gas is irrelevant to this conversation because it is used far less than oil in most industries, especially given the fact that far more electricity is generated from oil than natural gas.

N_Fiddledog N_Fiddledog:

Everyone seems to have forgotten about “peak oil” — the catchphrase of the new millennium.

Actually, this is EXACTLY what Hubert postulated - once all the easy oil was gone, we'd be so desperate that we'd need to access the hard to get stuff, which is precisely what fracking does.

N_Fiddledog N_Fiddledog:

Just two years ago, when up for reelection, Obama reminded Americans, “We can’t just drill our way to lower gas prices.”

He was right - it takes the Gulf sheiks to drill our way to lower prices because neither the US nor anyone else in the West can produce enough to satisfy our demand for oil.

That demand is why the US is STILL importing nearly 3 billion barrels of oil each year;

http://www.eia.gov/dnav/pet/hist/LeafHa ... RIMUS1&f=A

N_Fiddledog N_Fiddledog:

ARAB Oilmen, not US oilmen, returned hundreds of billions of dollars to American consumers. They, not Ivy League experts and Wall Street grandees, kick-started the economy where federal subsidies had failed to. They, not the policies of the Obama administration or the rhetoric of Secretary of State John Kerry, weakened our enemies.

Fixed that for you...