| |

| Author |

Topic Options

|

Posted: Posted: Wed Apr 10, 2019 11:27 pm

Oh and damn... I gave you the wrong wrong article in response to your "shutuppery" post, Beave. I gave you the one from the Financial Post. I meant to give you the one from the Toronto Sun. This one: Fighting climate change, one refrigerator subsidy at a time$1: If a family has to buy a new refrigerator because the carbon tax makes the power bill more expensive, that’s success in Ottawa’s view, even if it’s tough for that family.

But the rules are different for big business.

On Apr. 1, the federal carbon tax kicked in for Manitoba, New Brunswick, Ontario and Saskatchewan. The tax will add 4.4 cents per litre to the price of gasoline – rising to 11 cents by 2022 – and drive up the cost of everything from home heating to groceries.

The rationale, the federal government says, is to incentivize behavioural changes by making prices higher, since it hopes you won’t be able to buy as much gas and thus you’ll drive less. Besides, with a plan to rebate the money via a tax credit, it insists you won’t actually be out of pocket. In fact, the politicians promise you’ll actually be better off!

Set aside for a minute the magic math of collecting a new tax and redistributing it in such a way that everyone is somehow better off.

Ignore that fact that many essential goods – and especially the use of energy sources such as gasoline – are known as inelastic goods because demand remains relatively constant despite price changes. In other words, Canadians still need to drive to work and drop their kids off at school even if Ottawa pushes up the price at the pump. British Columbia has proven this point as its emissions are still rising, despite its carbon tax.

And never mind that the Trudeau carbon tax is set at a level far too low to get Canada anywhere near its own emissions targets, defeating the entire purpose of the tax.

A better question, highlighted by an announcement made by Environment Minister Catherine McKenna, is why the government’s ingenious plan to tax Canadians into prosperity doesn’t also apply to Canada’s wealthiest corporations?

McKenna’s big reveal was that her government is giving a $12 million taxpayer handout to Loblaw so that the company could upgrade the refrigerators in its stores, all in the name of helping fight climate change.

It would have been hard for McKenna to pick a less sympathetic recipient. Owned by one of Canada’s richest families, and recently embroiled in controversies over tax evasion and a bread price-fixing scheme, Loblaw turned a tidy profit of more than $800 million last year. If anyone “needed” a free $12 million handout, it surely wasn’t Loblaw.

Which brings us to an obvious question: if a new carbon tax is the best way to get Canadians to cut their carbon emissions, why does Loblaw get a subsidy instead? While grocery stores will pass on their carbon tax costs to consumers, they’re now cashing corporate welfare cheques from Ottawa. Shouldn’t the Trudeau government be hitting Loblaw – and every business – with a new tax, the better to “incentivize behavioural change?”

It’s almost as if the government is admitting that when it comes to businesses, piling on new costs is harmful. And yet it expects us to believe the opposite when it comes to Canadians trying to stretch their family budgets.

For a government that says it’s focused on the middle class, it has been unbelievably generous with large, mostly profitable corporations, with handouts to Bombardier and Toyota, not to mention its seedy subservience to the now-infamous SNC-Lavalin that sparked an unending scandal.

The Trudeau government was already having a tough time convincing skeptical Canadians the carbon tax would actually make them better off, rather than costing them money, while doing nothing to help the environment.

Now the government has piled on an additional contradiction.

Ottawa is using the carbon tax to pressure middle-class families into buying new fridges, but, if it’s one of Canada’s wealthiest families, Ottawa is all to happy chip in millions from taxpayers for new coolers.

|

Posts:

Posts: 15244

Posted: Posted: Thu Apr 11, 2019 6:57 am

N_Fiddledog N_Fiddledog: Oh and damn... I gave you the wrong wrong article in response to your "shutuppery" post, Beave. I gave you the one from the Financial Post. I meant to give you the one from the Toronto Sun. This one: Fighting climate change, one refrigerator subsidy at a time$1: If a family has to buy a new refrigerator because the carbon tax makes the power bill more expensive, that’s success in Ottawa’s view, even if it’s tough for that family.

But the rules are different for big business.

On Apr. 1, the federal carbon tax kicked in for Manitoba, New Brunswick, Ontario and Saskatchewan. The tax will add 4.4 cents per litre to the price of gasoline – rising to 11 cents by 2022 – and drive up the cost of everything from home heating to groceries.

The rationale, the federal government says, is to incentivize behavioural changes by making prices higher, since it hopes you won’t be able to buy as much gas and thus you’ll drive less. Besides, with a plan to rebate the money via a tax credit, it insists you won’t actually be out of pocket. In fact, the politicians promise you’ll actually be better off!

Set aside for a minute the magic math of collecting a new tax and redistributing it in such a way that everyone is somehow better off.

Ignore that fact that many essential goods – and especially the use of energy sources such as gasoline – are known as inelastic goods because demand remains relatively constant despite price changes. In other words, Canadians still need to drive to work and drop their kids off at school even if Ottawa pushes up the price at the pump. British Columbia has proven this point as its emissions are still rising, despite its carbon tax.

And never mind that the Trudeau carbon tax is set at a level far too low to get Canada anywhere near its own emissions targets, defeating the entire purpose of the tax.

A better question, highlighted by an announcement made by Environment Minister Catherine McKenna, is why the government’s ingenious plan to tax Canadians into prosperity doesn’t also apply to Canada’s wealthiest corporations?

McKenna’s big reveal was that her government is giving a $12 million taxpayer handout to Loblaw so that the company could upgrade the refrigerators in its stores, all in the name of helping fight climate change.

It would have been hard for McKenna to pick a less sympathetic recipient. Owned by one of Canada’s richest families, and recently embroiled in controversies over tax evasion and a bread price-fixing scheme, Loblaw turned a tidy profit of more than $800 million last year. If anyone “needed” a free $12 million handout, it surely wasn’t Loblaw.

Which brings us to an obvious question: if a new carbon tax is the best way to get Canadians to cut their carbon emissions, why does Loblaw get a subsidy instead? While grocery stores will pass on their carbon tax costs to consumers, they’re now cashing corporate welfare cheques from Ottawa. Shouldn’t the Trudeau government be hitting Loblaw – and every business – with a new tax, the better to “incentivize behavioural change?”

It’s almost as if the government is admitting that when it comes to businesses, piling on new costs is harmful. And yet it expects us to believe the opposite when it comes to Canadians trying to stretch their family budgets.

For a government that says it’s focused on the middle class, it has been unbelievably generous with large, mostly profitable corporations, with handouts to Bombardier and Toyota, not to mention its seedy subservience to the now-infamous SNC-Lavalin that sparked an unending scandal.

The Trudeau government was already having a tough time convincing skeptical Canadians the carbon tax would actually make them better off, rather than costing them money, while doing nothing to help the environment.

Now the government has piled on an additional contradiction.

Ottawa is using the carbon tax to pressure middle-class families into buying new fridges, but, if it’s one of Canada’s wealthiest families, Ottawa is all to happy chip in millions from taxpayers for new coolers. We get it. You think anytime someone dares to challenge your right wing narratives, it’s “shutuppery” And being challenged throws you off your game and causes you to make mistakes because you think your shaky opinions should be received as undeniable fact. Nobody is going to have buy a new fridge due to the carbon tax that’s just dumb And where are your complaints over the BILLIONS of subsidies handed over to oil and gas companies? For nothing! For continuing their bad behaviour while being the among most profitable industries in the world. The carbon challenge awards people businesses and municipalities for green initiatives and achieving ideal outcomes that benefit everyone and the small portion of the fund that went to Loblaw is a modest amount given the size of Loblaws operations. Loblaws is still spending $36M of its own money to do something positive that it wouldn’t have otherwise done

|

Posted: Posted: Thu Apr 11, 2019 11:14 am

BeaverFever BeaverFever: We get it. Who's this we? You got fleas or something? $1: You think anytime someone dares to challenge your right wing narratives, it’s “shutuppery” And being challenged throws you off your game and causes you to make mistakes because you think your shaky opinions should be received as undeniable fact. Brainless, irrelevant insults meant to do nothing but say "shut up" are "shutuppery." Anybody who wants to see what I'm talking about only has to click to the first page to see what started this. After that you were given a well supported explanation as to how government and its toadies have misrepresented statistics to hide the fact that emissions in BC have been increasing over at least the 6 years ending in 2016 when stats end. Forget all the snot-talk. If you actually have an argument to that show it to me.

|

Posted: Posted: Thu Apr 11, 2019 11:35 am

Oh, and you can add this one from January of 2018: B.C. Quietly Releases Emissions Update That Shows It’ll Blow 2020 Climate Target$1: Figures in a B.C. greenhouse gas inventory released quietly before Christmas show emissions have risen for four of the last five years.

Previously the province released a full public report on emissions, including inventory methodology, every two years but in December the government released a excel spreadsheet simply listing emissions figures for the second year in a row. The spreadsheet was published without any formal announcement or news release.

By law the province is required to reduce emissions 80 per cent from 2007 levels by 2050. In 2008 the province created a benchmark within that reduction, committing to get to 33 per cent reductions by 2020.

But the new figures show B.C. is not on course to meet that 2020 target. Instead emissions are only 2.1 per cent lower than the baseline year of 2007 and are on the rise... https://thenarwhal.ca/b-c-quietly-relea ... te-target/

|

Posts:

Posts: 8157

Posted: Posted: Thu Apr 11, 2019 1:27 pm

Your climate debates aside, why is Loblaws getting funding to reduce green house gasses?

They are very profitable, they can afford to do it all by themselves.

Give me the money so I can buy my wife a hybrid.

|

Posts:

Posts: 15244

Posted: Posted: Thu Apr 11, 2019 3:05 pm

Robair Robair: Your climate debates aside, why is Loblaws getting funding to reduce green house gasses?

They are very profitable, they can afford to do it all by themselves.

Give me the money so I can buy my wife a hybrid. How is this so hard to understand. The concept is not new. Governments often provide grants rebates etc to people or business in order to encourage them to do things that they might not otherwise do. It has nothing to do with ability to pay it has to do with willingness to pay. For example if you contribute to your kids education in a RESP you get a 20% grant from the federal government. Ontario used to have a rebate program for EVs but Doug the Grinch took it away.

|

Posts:

Posts: 1204

Posted: Posted: Thu Apr 11, 2019 6:16 pm

I can has free refrigerator?

|

Posts:

Posts: 15244

Posted: Posted: Thu Apr 11, 2019 8:19 pm

N_Fiddledog N_Fiddledog: Oh, and you can add this one from January of 2018: B.C. Quietly Releases Emissions Update That Shows It’ll Blow 2020 Climate Target$1: Figures in a B.C. greenhouse gas inventory released quietly before Christmas show emissions have risen for four of the last five years.

Previously the province released a full public report on emissions, including inventory methodology, every two years but in December the government released a excel spreadsheet simply listing emissions figures for the second year in a row. The spreadsheet was published without any formal announcement or news release.

By law the province is required to reduce emissions 80 per cent from 2007 levels by 2050. In 2008 the province created a benchmark within that reduction, committing to get to 33 per cent reductions by 2020.

But the new figures show B.C. is not on course to meet that 2020 target. Instead emissions are only 2.1 per cent lower than the baseline year of 2007 and are on the rise... https://thenarwhal.ca/b-c-quietly-relea ... te-target/FACT: the increase is nominal FACT: PEOPLE are producing fewer emissions and consuming less gas FACT: BCs emissions have been far lower than rest of Canada since the carbon tax BCs emissions would have been far higher without the tax. https://www.google.ca/amp/s/www.cbc.ca/amp/1.4758484https://www.google.ca/amp/s/vancouversu ... crease/amp

|

Posted: Posted: Thu Apr 11, 2019 11:18 pm

Speaking of nominal. Did you read this bit: $1: Instead emissions are only 2.1 per cent lower than the baseline year of 2007 and are on the rise... Gonna save the world with that, are you Beave?

|

Posted: Posted: Thu Apr 11, 2019 11:34 pm

This one below is from 2016 when they only had data from 2013. The emissions increase was starting to become noticeable even back then. $1: OK, but greenhouse gas emissions declined, right? Like other provinces, BC saw a recession-induced drop in emissions between 2008 and 2009, and a more modest drop in emissions in 2010. Another consideration is that when BC’s carbon tax was introduced in July 2008, fuel prices were peaking at around $1.50 per litre (in Vancouver, where I live), but the carbon tax was only 2.3 cents per litre out of that total. These factors – economic downturn and high fuel prices – better explain the drop in GHG emissions than the carbon tax, although arguably the carbon tax piled on.

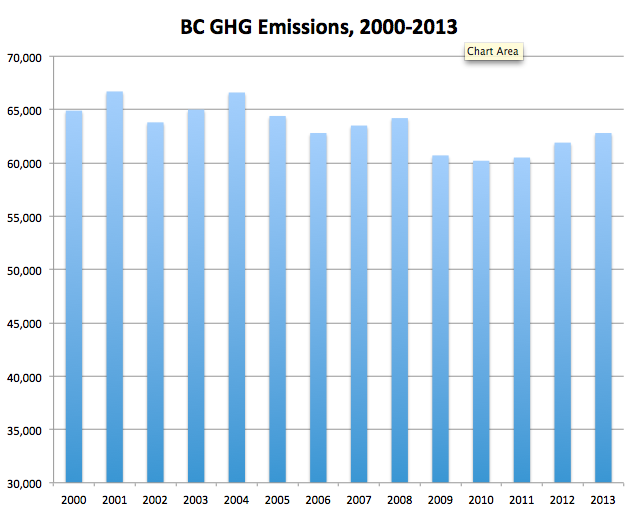

If you take 2007 or 2008 as your base year, then you can construct a story that BC’s emissions have fallen, but the reality is that since 2010, BC’s GHG emissions have increased every year; as of 2013 they are up 4.3 per cent above 2010 levels. More than two-thirds of this increase is attributable to the growth of BC’s natural gas industry (up 1.8 million tonnes). BC also recently conceded it will not be able to meet its 2020 GHG target.

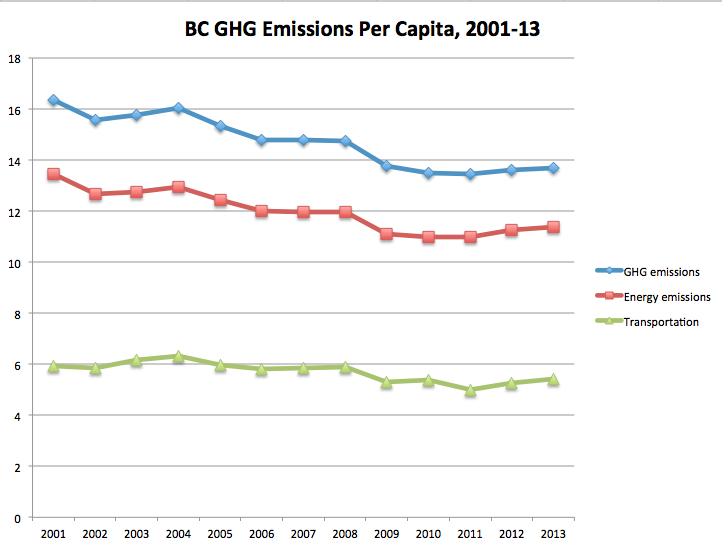

If you look at the fine print on claims about emission reductions, you may see it argued that it is per capita emissions that have fallen. Here’s an example from the other uncritical piece on BC’s carbon tax, from a report from newly-launched Smart Prosperity initiative, sponsored in part by Shell:

"British Columbia’s carbon tax leads the pack: The Secretary General of the OECD stated, 'British Columbia’s carbon tax is as near as we have to a textbook case' of effective carbon pricing. In the five years after it was introduced in 2008, the province’s per capita fuel use dropped 16%, while GDP growth kept pace with the rest of Canada."

Even if we allow for this shifting of the goalposts, it still does not hold up. Here’s the full trend going back to 2001:

Interestingly, BC’s per capita emissions were on a steady downward trajectory well before any real action on climate change. This may be due to shifts in industrial structure, and growing urbanization of the province’s population, and perhaps also due to other fuel taxes that preceded the carbon tax. This latter point bears some elaboration because fuel taxes are essentially carbon taxes on a smaller base. In perspective, BC’s carbon tax of $30 per tonne is 6.67 cents per litre at the pump, a small percentage of market price for gasoline. Other provincial fuel taxes are more substantial, ranging from 14.50 cents per litre in most of the province to 25.50 cents in the South Coast.

On a per capita basis, again we see the recession-induced drop in 2009 and 2010, then increases from 13.5 tonnes per person in 2010 to 13.7 tonnes per person in 2013. If we just look at energy emissions, the increase is from 11.0 tonnes per person in 2010 to 11.4 in 2013. Even more narrowly, transportation emissions bottom out in 2011 at 5.0 tonnes, then grow by 8% to 5.4 tonnes per person in 2013.

So basically, let’s cut the crap about BC’s carbon tax. The impact of the carbon tax has been overstated by people who love carbon taxes, and it’s annoying that the tax has generated so much uncritical praise. http://behindthenumbers.ca/2016/03/03/d ... arbon-tax/

|

Posted: Posted: Fri Apr 12, 2019 12:35 am

I was going to leave it there but I did something Beave never seems to do. I actually clicked his links and read them. Here's one: BeaverFever BeaverFever: Hang on...I'm still laughing. Wanna see why? Just read the title: Latest figures show B.C.'s carbon emissions continue to increaseor if you'd like more hilarity read the whole article. It says the exact opposite of what Beave is hoping to sell. And it's his freakin' link. Emissions are increasing in BC in spite of the Carbon tax. The article Beave posted says so.  Here's a sample: $1: The latest figures, for the year 2015, estimate B.C.’s carbon emissions at 63.3 million tonnes of carbon equivalent, an increase of 1.6 per cent over the previous year.

More critically, the emission level is only two per cent less than in 2007, putting the province a long way from its original legislated target of reducing emissions 33 per cent by 2020 over 2007. https://vancouversun.com/business/energ ... o-increase"B.C.'s carbon emissions continue to increase." Says so right in the title.

|

Posts:

Posts: 15244

Posted: Posted: Fri Apr 12, 2019 4:54 am

N_Fiddledog N_Fiddledog: Speaking of nominal. Did you read this bit: $1: Instead emissions are only 2.1 per cent lower than the baseline year of 2007 and are on the rise... Gonna save the world with that, are you Beave? Considering that emissions would normally have have gone up considerably over more than 10-years of economic and population growth, this shows that taxes curb emissions.

|

Posts:

Posts: 15244

Posted: Posted: Fri Apr 12, 2019 4:57 am

N_Fiddledog N_Fiddledog: I was going to leave it there but I did something Beave never seems to do. I actually clicked his links and read them. Here's one: BeaverFever BeaverFever: Hang on...I'm still laughing. Wanna see why? Just read the title: Latest figures show B.C.'s carbon emissions continue to increaseor if you'd like more hilarity read the whole article. It says the exact opposite of what Beave is hoping to sell. And it's his freakin' link. Emissions are increasing in BC in spite of the Carbon tax. The article Beave posted says so.  Here's a sample: $1: The latest figures, for the year 2015, estimate B.C.’s carbon emissions at 63.3 million tonnes of carbon equivalent, an increase of 1.6 per cent over the previous year.

More critically, the emission level is only two per cent less than in 2007, putting the province a long way from its original legislated target of reducing emissions 33 per cent by 2020 over 2007. https://vancouversun.com/business/energ ... o-increase"B.C.'s carbon emissions continue to increase." Says so right in the title.  This point has already been made to you repeatedly: either you’re too dense or playing dumb 1.6% for ONE YEAR is NOMINAL. The targets may be overly agreeable but that’s not the same as your phony claim that taxes do nothing to curb emissions

|

Posts:

Posts: 4039

Posted: Posted: Fri Apr 12, 2019 5:14 am

MeganC MeganC: I can has free refrigerator?  Only if you run a multi-billion dollar corporation and are too lazy/cheap to get one yourself.... Board of directors: "Hey Galen, we could use some of those new green fridges. Let's put aside a few million dollars from the billions we made last year."

Galen Weston: "That's not how business works."Board of directors: "Eh?" Galen Weston: "We can get those fridges, and not spend a penny of our own money!"Board of Directors: "It's that easy?"Galen Weston: "Watch this." *picks up phone, dials 1-800-TRU-DEAU, and puts it on speaker phone* Automated voice: "Thank you for calling Mr. Dressup. Please listen carefully to your options. Press one for a photo op. Press two to discuss socks. Press three if you're a feminist wanting to report male slime to the Persecutor's office. Press four to watch the budget balance itself. Press five if your a corporation that needs millions of free dollars courtesy of Canadian taxpayers already bent over. Press six to blame Harper for anything I've done to you myself. To go back to the main menu, deposit 10 dollars."Board of Directors: "Seems legit."  -J.

|

Posts:

Posts: 18770

Posted: Posted: Fri Apr 12, 2019 6:34 am

CDN_PATRIOT CDN_PATRIOT: MeganC MeganC: I can has free refrigerator?  Only if you run a multi-billion dollar corporation and are too lazy/cheap to get one yourself.... Board of directors: "Hey Galen, we could use some of those new green fridges. Let's put aside a few million dollars from the billions we made last year."

Galen Weston: "That's not how business works."Board of directors: "Eh?" Galen Weston: "We can get those fridges, and not spend a penny of our own money!"Board of Directors: "It's that easy?"Galen Weston: "Watch this." *picks up phone, dials 1-800-TRU-DEAU, and puts it on speaker phone* Automated voice: "Thank you for calling Mr. Dressup. Please listen carefully to your options. Press one for a photo op. Press two to discuss socks. Press three if you're a feminist wanting to report male slime to the Persecutor's office. Press four to watch the budget balance itself. Press five if your a corporation that needs millions of free dollars courtesy of Canadian taxpayers already bent over. Press six to blame Harper for anything I've done to you myself. To go back to the main menu, deposit 10 dollars."Board of Directors: "Seems legit."  -J. How many would press #2 just for the fun of it.

|

|

Page 2 of 3

|

[ 35 posts ] |

Who is online |

Users browsing this forum: No registered users and 30 guests |

|

|